Deserving of better: How American seniors are paying for misaligned incentives within Medicare Part D

Millions of America’s elderly rely on the Medicare Part D program to afford prescription medications. Because adherence to prescription medications is a primary determinant of treatment success, Medicare Part D represents one of the most critical programs to the overall health of the elderly in this country. However, despite the availability of a prescription drug benefit, many Medicare beneficiaries still struggle to afford prescription drugs. It is well documented that the United States pays more for prescription medications than any other country in the world. As countless studies have demonstrated that as patient cost increases adherence to therapies decrease, it is perhaps unsurprising that America’s health outcomes are not achieving the desired results.

The Centers for Medicare and Medicaid Services (CMS), the federal body responsible for oversight of the Medicare Part D benefit, reports a growing disparity between gross Part D drug costs, calculated based on costs of drugs at the pharmacy counter, and net Part D drug costs, which account for all Direct and Indirect Remuneration (DIR). DIR is a broad name given to additional discounts a Part D plan sponsor (or their contractor, i.e., pharmacy benefit manager (PBM)) negotiates within the drug supply chain above the pharmacy counter price, such as retroactive pharmacy price concessions or manufacturer rebates. The growing divergence between gross and net spending in Medicare Part D has significant implications for the Part D program. This is because the majority of a Medicare enrollee’s cost share is determined from gross, and not net, drug spending.

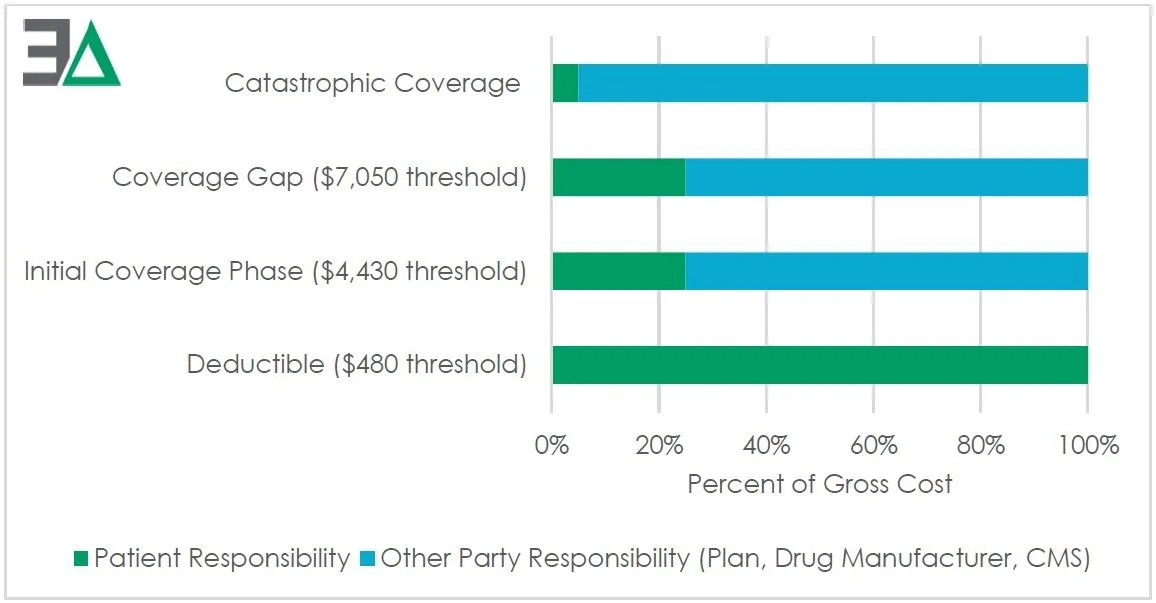

Figure 1: Medicare Part D standard plan parameters, patient cost sharing liability for 2022

According to CMS’ own analysis, the implications of this trend include: (1) higher Medicare Part D cost-sharing for members because cost sharing is calculated based on the drug price at the pharmacy point-of-sale (POS), without regard to rebates and other discounts received after the point-of-sale; (2) quicker progression of Part D enrollees through the Part D drug benefit phases due to higher beneficiary cost sharing; (3) higher costs to the federal government as more patients reach the catastrophic phase of Medicare coverage, where Medicare liability is generally about 80%; and (4) an increase cost to Medicare for covering cost-share requirements of the most needy seniors enrolled in Medicare’s low income subsidy program. Under current Part D rules, the largest share of all rebates and other discounts allocated to reduce the Medicare Part D plan liability. In other words, Part D sponsors, who control drug spending for Medicare, are in fact responsible for only a share of Part D drug spending, and as a result of the increasing preference for high price Direct and Indirect Remuneration (DIR) arrangements, that proportion is shrinking each year.

Medicare is not the first program to struggle with prescription drug costs. Medicaid, another federal program overseen by CMS, has adopted a relatively new model for paying for prescription drugs – one that aligns program costs to surveyed benchmarks meant to approximate the prices paid by pharmacies to purchase medications. The most common benchmark utilized by state Medicaid programs is National Average Drug Acquisition Cost (NADAC), which is typically used as the basis for both the state’s cost exposure and the pharmacy’s reimbursement for the drug’s ingredient cost. Because NADAC is meant to cover just the cost of the drug itself, it is then coupled with a professional dispensing fee that is meant to cover the cost of the service and overhead incurred by pharmacy providers.

Amidst growing complaints from providers and patients regarding the inflated and unpredictable prices for prescription drugs within the program, 3 Axis Advisors was asked by the American Pharmacy Cooperative, Inc. (APCI) and the American Pharmacists Association (APhA) to explore how application of the bedrock of Medicaid’s drug pricing design into Medicare might alleviate ballooning costs within the program.

In this study, we found that Medicaid’s NADAC-plus-professional-dispensing-fee model offered an overall point-of-sale spending decrease, and savings to Medicare beneficiaries as a result of their reduced cost sharing obligations. Specifically, we found:

Savings of 8.4% ($499.78 million to $457.86 million) on 8,553,375 Part D transactions dispensed in 2021 at over 1,000 community pharmacies;

Reductions in average beneficiary cost at the pharmacy counter for brand prescriptions by $43.74 (487,507 transactions), and $2.56 (8,065,868 transactions) per generic prescription.

Figure 2: Part D (2021) current pricing to NADAC model differences (millions ($))

Applying these results to the entire Medicare Part D program in 2021, the NADAC-based model offers $18.17 billion in potential point-of-sale (POS) cost reductions for the benefit of Medicare enrollees.

Furthermore, a detailed multiyear analysis of a large Part D plan demonstrated that the alternative NADAC-based model would have reduced the pharmacy counter brand prices by 8.0% and generic prices by 34.8% over the current PBM-managed model. Patient cost sharing obligations under this new model, which do not receive the benefit of retrospective DIR, would see a savings of approximately $10 per claim for impacted claims (those with a cost share greater than the net pharmacy price) in this large Part D plan going forward.

America’s elderly deserve a better Medicare Part D benefit. Efforts to reform Medicare Part D that fail to address inflated out of pocket costs for seniors will result in a current problem getting materially worse in the future. Similarly, efforts to reform Medicare that fail to address the incentives that encourage Part D plan sponsors to forgo managing costs at the pharmacy counter, and instead shift costs and risks onto the federal government, will only result in higher costs to the federal budget.

If you have questions about this report, please contact us at info@3axisadvisors.com.